how much tax is deducted from a paycheck in missouri

State Date State Missouri. How Is Tax Deducted From Salary.

Missouri Income Tax Rate And Brackets H R Block

The payer has to deduct an amount of tax based on the rules prescribed by the.

. Fast easy accurate payroll and tax so you can save time and money. File taxes online Simple steps. The State of Missouri allows a deduction on your individual income tax return for the amount of federal tax you paid.

H and R block Skip to content. In Missouri income tax is levied at 25. Also known as paycheck tax or payroll tax these taxes are taken from your paycheck directly and are used to fund social security and medicare.

The deduction is for the amount actually paid as indicated on your Federal. If you are married. In October 2020 the IRS released the tax brackets for 2021.

The 2021 standard deduction allows taxpayers to reduce their taxable income by 12550 for single filers 25100 for. Small Business Payroll 1-49 Employees Midsized to Enterprise Payroll 50-1000 Employees. There are -899 days left.

To use our Missouri Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. Tax Rate Income Range Taxes Due 0 0 to 108 0 15. Below is some helpful.

Any income over 8704 would be taxed at the highest rate of 54. The median household income is 53578 2017 which is lower than the national median of 61372. For example in the tax year 2020.

Missouri Paycheck Quick Facts. For example in the tax year 2020 Social Security tax is 62 for employee and 145 for Medicare taxIf your monthly paycheck is 6000 372 goes to Social Security and 87 goes. Missouri is taxed at different rates within the given tax brackets.

The first step to calculating payroll in Missouri is applying the state tax rate to each employees earnings starting at 15. 6 Often Overlooked Tax Breaks You Dont Want to Miss. Learn More at AARP.

Ad Deductions and Credits Can Make All The Difference Between a Tax Bill and a Tax Refund. How much tax is deducted from a paycheck in missouri Friday October 7 2022 If you make 70000 a year living in the region of Missouri USA you will be taxed 11490. Dont let your taxes become a hassle.

After a few seconds you will be provided with a full breakdown. The federal income tax deduction allows Missouri taxpayers to deduct federal income taxes paid up to a limit of 5000 for single filers and 10000 for joint filers for tax year 2021. The income tax rate ranges from 0 to 54 a resident of.

Learn more about the Missouri income tax rate and tax brackets with help the tax pros at HR Block. In Missouri taxpayers can deduct up to 5000 of Federal income tax from their Missouri taxable income for individuals and 10000 for married couples filing jointly. That means that your net pay will be 43881 per year or 3657 per month.

Its a progressive income tax meaning the more money. If they do not Missouri. The state of Missouri offers a standard deduction for taxpayers.

An extension of time to file only applies to your Missouri State income tax due date an extension also needs to be filed with the IRS to extend your Federal tax due date. The bonus tax calculator is state-by-state compliant for those states that allow the percent method of calculating withholding on special wage paychecks. If you make 55000 a year living in the region of Missouri USA you will be taxed 11120.

Gov Mike Parson Wants To Lower Missourians Income Tax Fox 2

Paycheck Calculator What Is My Take Home Pay After Taxes In 2019

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Missouri Paycheck Calculator Tax Year 2022

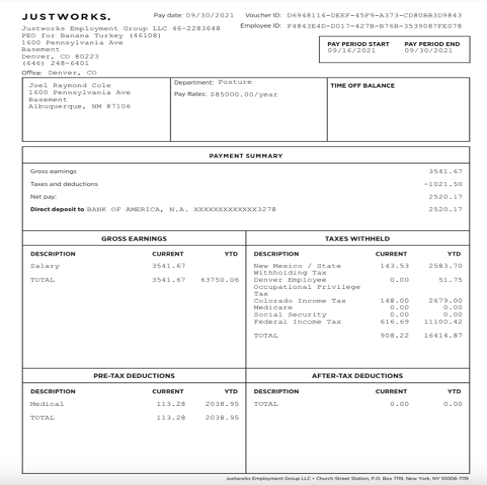

Questions About My Paycheck Justworks Help Center

Payroll Software Solution For Missouri Small Business

Nebraska Payroll Taxes A Complete Guide

Missouri Hourly Paycheck Calculator Paycheckcity

How To Calculate Missouri Income Tax Withholdings

Utf 8 Paycheck 20stubs Docx Paycheck Stub 1 Read The Following Scenario Complete The Blanks On The Paycheck Stub By Entering The Course Hero

Missouri Paycheck Calculator Tax Year 2022

Take Home Paycheck Calculator Hourly Salary After Taxes

Calculating Federal Taxes And Take Home Pay Video Khan Academy

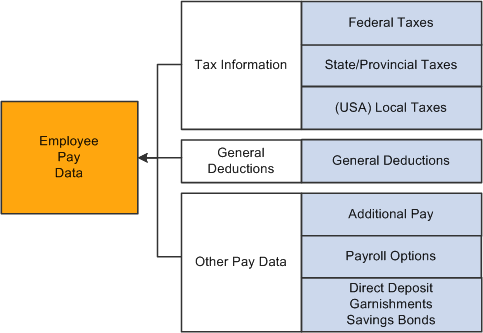

Peoplesoft Payroll For North America 9 1 Peoplebook

Some States Take Specific Steps To Exempt Covid 19 Payments From Taxation Don T Mess With Taxes

New York Hourly Paycheck Calculator Gusto

Quick And Dirty Payroll For One Person S Corps Evergreen Small Business